With credit card skimming crimes escalating nationwide, the U.S. Secret Service’s Washington Field Office is sharing essential tips for the public to protect themselves from this growing threat, shared by Officials in LinkedIn post.

According to the agency, credit card skimming involves criminals installing illicit devices to steal card information, has become a “low-risk, high-reward” crime.

Recent efforts, such as Operation Potomac, have uncovered 24 skimming devices in the Washington area—but law enforcement warns that new devices appear daily.

How to Spot Skimmers

The Secret Service advises all consumers to remain vigilant, particularly at ATMs and gas pumps—two of the most common targets for skimming devices.

Here are their key recommendations for spotting skimmers before falling victim:

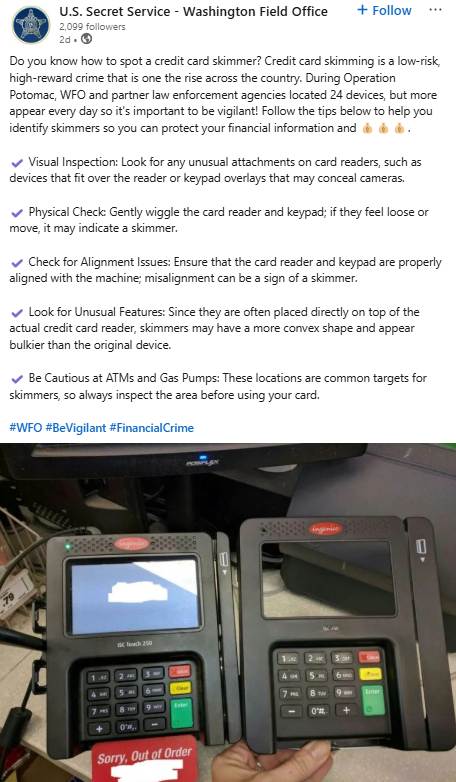

- Visual Inspection: Before inserting a credit or debit card, carefully inspect the card reader and surrounding area for any unusual attachments or added devices. Skimmers are often placed directly on top of the legitimate card reader and may include a bulging keypad or small pinhole cameras to capture PIN codes.

- Physical Check: Gently wiggle the card reader and keypad. Authentic machines are solidly built, so any looseness or odd movement may indicate a skimmer has been installed.

- Check for Alignment Issues: Skimming devices are rarely a perfect fit. Look for misalignments or gaps between the card reader, keypad, and the main machine. Any irregularities or visible glue/tape could be a sign of tampering.

- Look for Unusual Features: If the card reader or keypad appears bulkier, more convex, or of a different color than the rest of the terminal, it may be concealing a skimming device.

- Be Extra Cautious at ATMs and Gas Stations: These locations are prime targets due to their high traffic and often less direct oversight. Inspect the machine carefully and, if anything seems off, use another terminal or go inside to pay.

The Secret Service stresses the importance of public awareness as criminals continue to adapt their tactics. “During Operation Potomac and other enforcement efforts, we’ve seen the number of devices increase, so vigilance remains key,” the agency said in a statement.

If you suspect a skimmer, do not use the machine and alert the business and local authorities immediately.

Regularly monitoring your account for unauthorized transactions can also help you spot fraud early.

By taking these precautions and remaining alert, consumers can protect their financial information and help authorities combat this evolving crime.

Find this News Interesting! Follow us on Google News, LinkedIn, & X to Get Instant Updates!

.png

)